Mortgage Services

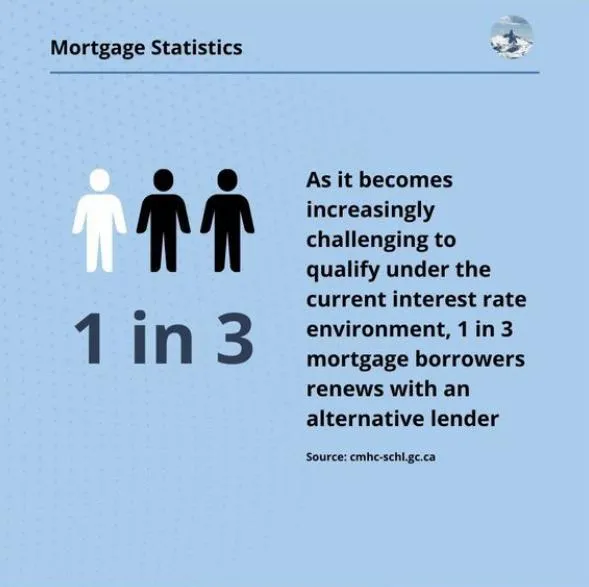

one in three mortgage applicants now seek an alternative mortgage

there is "no one size Fits all" lender or product

qualifying criteria, rates, fees, terms and renewal options vary a lot

it's easy to get stuck in the wrong mortgage

the right broker can can help you find the right option

let me help you find your perfect mortgage

Partnering With a Lic. Mortgage Broker /Owner For Success

A good Lic. Mortgage Broker /Owner does more than find the best interest rate. I'll guide you through the process, educate you, address your concerns, and support you long after the transaction.

Since a mortgage is a long-term commitment, your choice in a mortgage professional should be too. Never rush into a Mortgage Application. Let’s talk first & understand your needs. We truly want to get to know you. We listen and ask questions.

Privately owned we are under no pressure to sell one brand over another and always take time to explain the process.

Common financing we assist with where clients were not able to get approved at their bank:

'Large Mortgaes

No Payment' Mortgages

Debts Consolidation

Self-Employed Mortgages

Equity Lending

Bruised Credit Programs

Private Financing

Separation Buy Out

Bridge Loans

Frequently Asked Questions

Trusted Guidance, Proven Success

Peter Fabry | Lic. Mortgage Broker /Owner

(289) 212-7676

Assistance Hours

Mon – Fri 10:00am – 7:00pm

Saturday/Sunday – by appointment

Get In Touch With

(289) 212-7676

Assistance Hours

Mon – Fri 9:00am – 7:00pm

Saturday/Sunday – by appointment

Contact Me

Common Mortgage FAQ

What is a pre-qualification?

A pre-qualification is when you provide generalized information to a lender or online calculator, without the information being confirmed, and receive an estimated max purchase price.

What is a pre-approval?

A pre-approval is when a qualified mortgage professional reviews the information provided, such as your mortgage application, income & down payment documents, along with verifying your credit bureau to provide you with a more accurate max purchase price.

What is an approval?

After you have an accepted offer to purchase your dream home, your Mortgage Broker will submit your information to a lender. Once the lender reviews & confirms all the information provided, they will provide you with a full approval.

How much do I need for a down payment?

If you're buying an owner-occupied property, you may be eligible to put as little as 5% down. Keep in mind that just because the minimum down payment is 5%, you still need to qualify for the total mortgage amount (based on your income & debts).

Many people don't realize that the rules change for a purchase price above $500,000. In this case, you will require 5% on the 1st $500K and 10% on the remainder (up to $1M). If you're purchasing a home for over $1M you will require a minimum of 20% down.

If you're purchasing a rental property you will require a minimum of 20% down.

What if I don't qualify for the home I want?

This is where your mortgage professional can help provide you options, such as adding a co-signer, increasing your down payment and/or paying off debts. A Mortgage Broker/Agent has access to multiple lenders, so even if don't fit certain lender guidelines, they can shop around to see if another lender may approval your application.

What is a co-signer?

A co-signer is typically added to your application when you don't qualify for a home on your own. We add their income and debts to your application, to see if it increases your overall approval numbers. When someone cosigns for you, they will be added to the title of the mortgage and mortgage documents. This new mortgage debt will also appear on their credit bureau, which can affect their future credit score & loan affordability.

What is a guarantor?

A guarantor is typically added to your mortgage application when you have poor credit repayment or little to no credit history. Sometimes lenders will request a guarantor when your application is slightly weaker than they would want to see to approve you on your own. In most cases, the mortgage will not show on the guarantor's credit bureau, but this can vary from lender to lender.

What is Default Insurance?

Most people refer to this as CMHC fees. That said, there are actually 3 companies that provide this insurance to Canadians, CMHC, Sagen and Canada Guaranty.

This is insurance is mandatory for those who purchase a home with less than 20% down. Default insurance is then added to your mortgage and increases your overall mortgage amount.

Even though this is an added cost to buying a home, it's still a great way to get into the market when you don't have a 20% down payment. Default insurance is meant to protect your lender, in the event you stop making your mortgage payments & the lender has to foreclose on you.

© 2025 Broker It! - All Rights Reserved.

Peter Fabry, Lic. Mortgage Broker /Owner ON M08003151 NB 240059400 NS 2024-3000792

11082191 Canada Inc.o/a ‘Broker It’ is a Lic. Mortgage Brokerage ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681

For reverse mortgage info. specific to thos 55+ visit www.rewindmortgage.ca