Are you thinking about buying a home? The journey to homeownership can be both exciting and overwhelming. To help you navigate this process smoothly, I’ve compiled 12 essential tips. From choosing the right Lic. Mortgage Broker /Owner to securing the best interest rates and using mortgage calculators effectively, these tips will make all the difference in your home-buying experience in Ontario. [LEARN MORE]

BY Peter Fabry | 12/25/2025 |

How Do I Pay Off My House Faster?

Tips on how to pay off your mortgage and other debts fast. [Keep Reading]

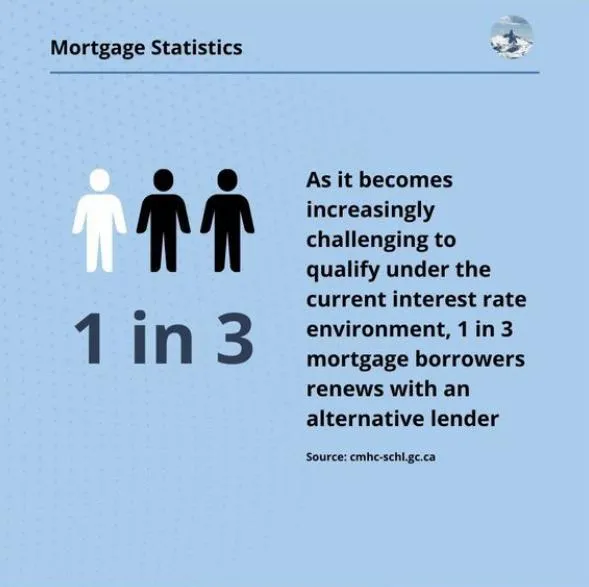

Why Exploring Your Options for Mortgage Renewal Can Save You Thousands

Renegotiating your mortgage at renewal time is an excellent way to save money! [Learn How]

Buy Your Kids a House So They Can Move Out

If you've ever said the words "My kids will never be able to afford to move out!"...[Keep Reading]

With remote work gaining popularity, lenders are adapting to homeowners relocating. Here are a few things to consider before packing your bags and moving.

"Where does my deposit go after I buy a home?" is a common question. Read this blog to follow the deposit steps in your real estate transaction.

If you're disappointed with your pre-approval amount or found a home just outside your budget, read this blog to learn how to increase your numbers.

This trend is growing in popularity as Canadians seek affordability and ways to enter the market. Read on to see if it can benefit you and learn how it works!

Many entrepreneurs are surprised to learn they have multiple tax-saving strategies with real estate and mortgages. Keep reading to learn how others are doing it.

Trusted Guidance, Proven Success

Peter Fabry | Lic. Mortgage Broker /Owner

(289) 212-7676

Assistance Hours

Mon – Fri 10:00am – 7:00pm

Saturday/Sunday – by appointment

Get In Touch With

(289) 212-7676

Assistance Hours

Mon – Fri 9:00am – 7:00pm

Saturday/Sunday – by appointment

Contact Me

© 2025 Broker It! - All Rights Reserved.

Peter Fabry, Lic. Mortgage Broker /Owner ON M08003151 NB 240059400 NS 2024-3000792

11082191 Canada Inc.o/a ‘Broker It’ is a Lic. Mortgage Brokerage ON 13336 NS 2023-3000791 NL 24-07-110007 NB 240054445 PEI 727141681

For reverse mortgage info. specific to thos 55+ visit www.rewindmortgage.ca